MyPremierCreditCard Login: This guide is a complete review of the “PREMIER Bank Credit Card” that you can obtain from mypremiercreditcard. In fact, you will exactly discover Login, Balance, and make the payment process with some extra additional information that might surprise you. This MasterCard is one of the most popular; the top 20 issuers in America and it is released by “First Premier Bank”.

Contents

MyPremierCreditCard : History

Established in 1989 AD by T. Denny Stanford, First Premier Bank is the 13 Th largest providers of MasterCard in the USA winning the Excellence Award 4 times. Their headquarters is located in Sioux Falls, South Dakota. Other than credit cards, they also provide services such as savings account, loans, and other banking products. These cards are branded under Visa and MasterCards. Users around major cities of America such as Arkansas, New York, New Mexico, Oklahoma, West Virginia, etc. have been benefitted from these credit cards as mentioned in their testimonials.

With that, they also provide an online website as well as a mobile platform to make transactions, enrol for an account, apply for credit cards, access credit card reports and information on products and receive regular alerts with so much more features inside it. They have released an app for smartphone users which is available in both android and iOs operating system. The app is built to save your time by monitoring recent activities, managing the card, schedule payments and a lot more on the go 24/7. It is highly reliable in terms of security and receives regular updates from the developers’ hub.

MyPremierCreditCard: Pricing

My Premier Credit Card is considered too much expensive as suggested by customer feedback on different online forums. They charge you a monthly fee, annual fee, and application-processing fee. The monthly fee costs around $6.25 – $10.40 (USD), the annual fee may range from $75 – $125 for the first year and then $45 to $49 later annually. The application processing tax ranges from $25 to $95 and if you don’t pay within 85 days, then they will withdraw your application. That means you will be charged up to $300 to $400 dollars in the first years with no rewards which is ridiculously considered to be too much expensive by customers. Their credit limit may range from $300 – $1,000 USD as it changes according to your credit balance and as your account gets older than one year.

MyPremierCreditCard Login

MyPremierCreditCard Login Portal is the Credit Card Service Provider which is a Member of the National Association of Manufacturers. The First Premier credit card is intended For People trying to refurbish their Credit. The First Premier credit card is Published by the First Premier Bank, and it is an unsecured card mainly Designed for People who are trying to raise their Credit Scores. To Login to the MyPremierCreditCard to Get Data and Information to Your Account You need to create an Online Account and enrol the respectable Webpage. After Login Into Your Account, You could use it for Paying Payment Online and Additionally get entry to Accounts every time You want. MyPremierCreditCard can be used anywhere else You have a Credit Card and You can Pay with Cash or Online with Debit Card on Your Regular Credit Card.

Guide to login into ‘My Premier Credit Card’ account

It is easy to log in and access into First Credit Card account online. Creating an account online means you will be able to pay bills online, check current balance and available credit, see transaction history and discover online statements and letters from the company. But before you can log in, you must already have an account created within the bank. Also, you should have obtained the MasterCard by visiting their branch. After you have completed these two formalities, you should perform the following steps, keeping in mind that you will need a computer and internet connection:

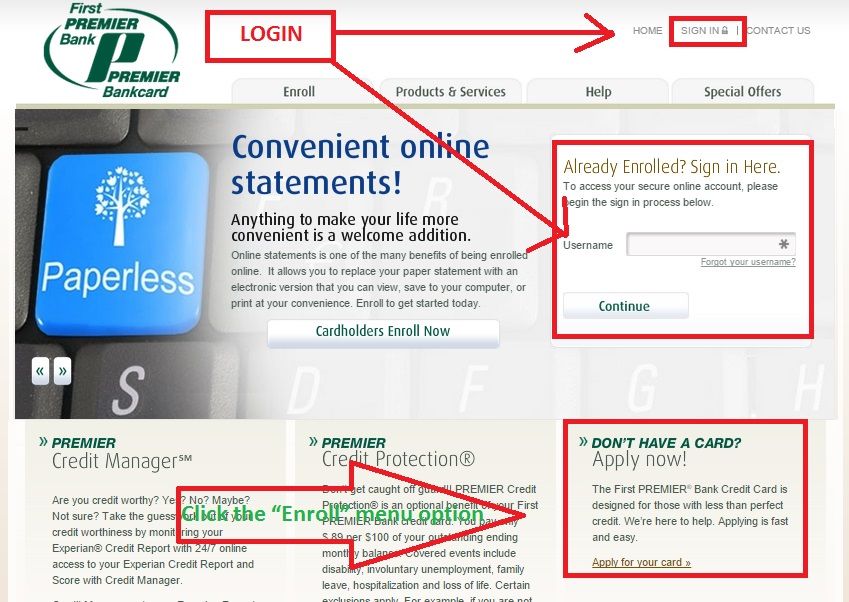

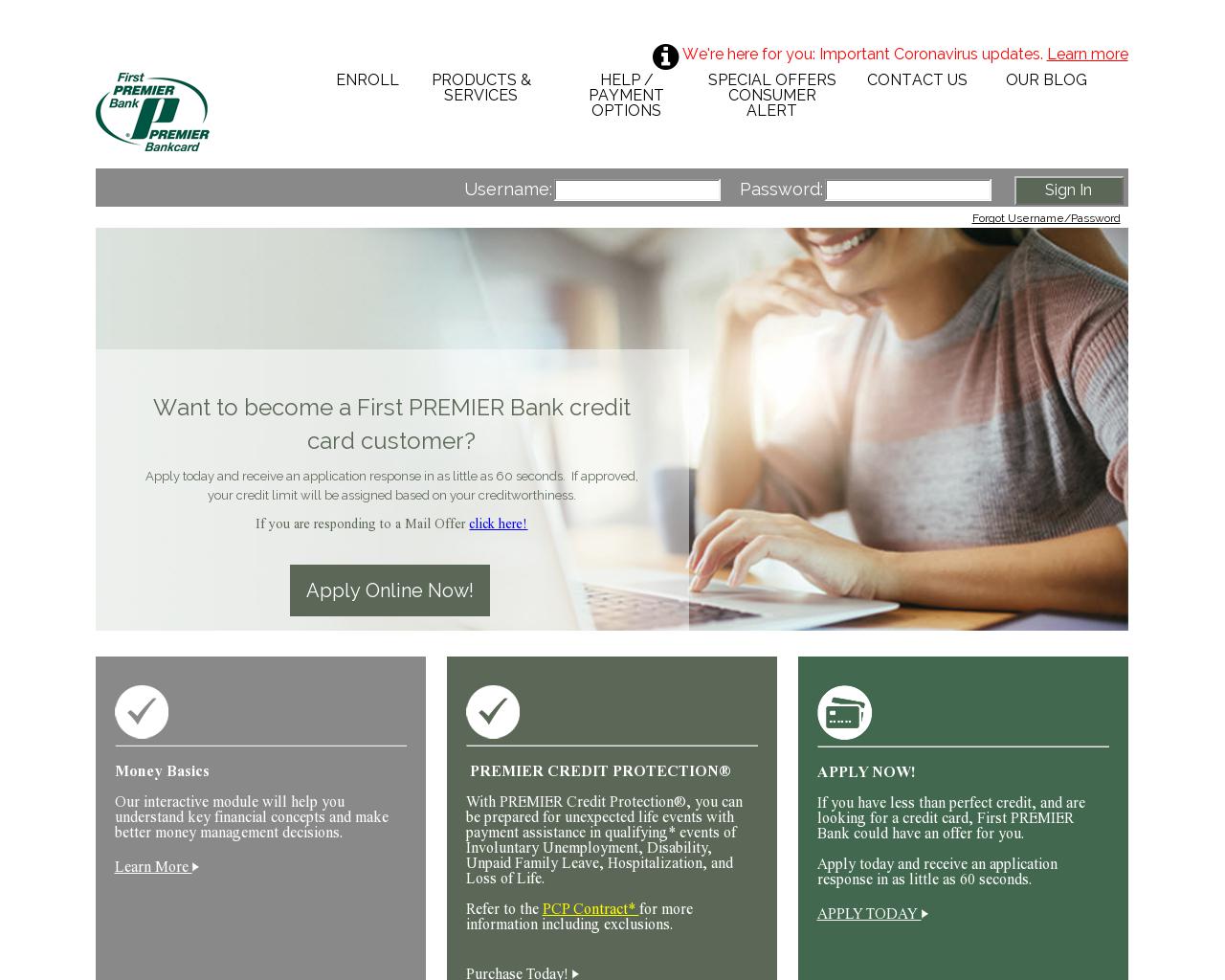

- First of all, connect your PC to the internet and visit their official website from any browser like Chrome, Opera, Firefox, Mozilla, Netscape Navigator, Explorer, Dolphin, etc. All of these are safe web browsers. Alternatively, you can download and install the Android or iOs app to log in or sign up. In this guide, we will be using a desktop version of their official website.

- Once the page loads, click on “Enroll”.

- You will see different boxes entitled “Account Number” and “Social Security Number” on the enrol page. You will get those details on the cover of your cheque book or MasterCard. If you don’t get those details, you may call their customer service for assistance. Once you find those data, fill the boxes properly with correct information and click on “Continue”.

- They will ask you for more details in the upcoming steps. Fill those properly and your account will be ready shortly.

- Once your account is ready, visit their homepage and submit your username/password and click on “Continue” to log in.

This was a short and easy process to login into MyPremiereCreditCard account online. Now you can access their services from home on the go.

How To Make Bill Payments?:

Follow these steps to make payments online from a mypremiercredit card:

- Log in to your account as mentioned earlier on this guide.

- After logging in, click on the “Make A Payment” option.

- There you can select if you want to pay the entire amount in your account or just the minimum amount. You can also select a custom amount other than these two.

- After selecting the right amount that fits you, click on the payment button and you’re done.

They now also support automatic monthly payments. Plus, there are other payment options that you can make like US Postal Mail, Express Mail, Payment by Phone, Cash Payment, Bank Wire, etc.

Please Note: It is strongly advised that you should make payments of the owed amount before the due date to save yourself from extra charges.

How To check the balance and available credit?:

Once you are able to log in, you can check your account balance to avoid penalties and restrictions. There you can calculate the amount of income that you will require to maintain a credit card balance and make payments through it. You can find the remaining credit, transaction history, and purpose for making it. Similarly, to make any kind of payments, you will need to have sufficient available credit. So you can check available credits online from their official website. There is no secret to accessing these features. They are clearly found on the top menu with their respective titles and simply click on the link next to them to enjoy their services.

Final Words:

In conclusion, it is always a relief to have MasterCard in your wallet for saving your valuable time. I hope that you find the information on this guide helpful. If you got benefited from reading this article, give me a shout out and drop a comment right now. Thank you in advance for visiting our website. Please check other cool stuff on here as well.